(603) 537-1112

The One Big Beautiful Bill Act (OBBBA): Understanding your 2025 W-2

What is the One Big Beautiful Bill Act?

- Beginning with the 2025 tax year, workers in tipped and overtime‑eligible occupations may qualify for two new federal deductions created by the One Big Beautiful Bill Act (OBBBA). This page explains how to read your 2025 W‑2 under these new rules.

- Up to a $25,000 deduction for qualified tips.

- This deduction is for workers in occupations that customarily receive tips (I.E., servers, bartenders, hairstylists, etc.).

- Qualified tips include:

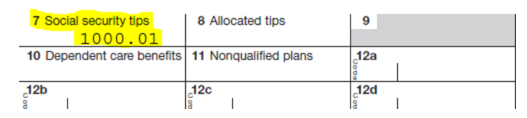

- Tips reported in box 7 on your W-2.

- Tips reported to your employer on your monthly form 4070 reports.

- Tips your employer can optionally list in box 14 of your W-2.

- Unreported tips that are listed on form 4137.

- Qualified tips do not include any mandatory gratuity such as (but not limited to) mandatory delivery fees and mandatory gratuity for large parties.

- Up to $12,500 (single filer)/$25,000 (joint filer) deduction for qualified overtime.

- Deductions are only for the additional 50% premium paid for hours over 40 (the half in time -and-a-half) and strictly follow FLSA guidelines for overtime wages earned.

- Not included are any state required overtime wages beyond FLSA minimums as well as employer provided double time or other special overtime programs beyond the FLSA mandated portions.

- Up to a $25,000 deduction for qualified tips.

Did the IRS make any changes to the 2025 Form W-2?

- No, Form W-2 will remain the same in look for 2025, even though these changes are in effect for 2025. As a part of this, employers are not required to separately report these qualified amounts for 2025 as confirmed by the IRS.

- To help provide a measure of clarity for reporting year 2025 Business Cents, Inc and your employer have provided a qualified overtime amount in box 14 that you may use when filing your taxes.

- For qualified tips it is recommended that you use the amount that is listed in box 7 of your W-2.

2025 W-2 FAQs

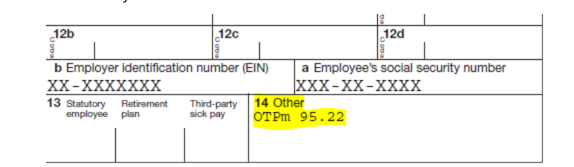

- What is the OTPm amount that is listed in box 14?

- This amount represents the estimated amount of premium overtime that you have earned in 2025 based on our records and IRS recommendations. Box 14 is considered for informational purposes only, so if this amount seems incorrect to you, it is best that you work with your tax professional and keep documentation of your calculations. No W-2 correction would be required due to the informational only nature of box 14. Below is a picture of what this will look like on your W-2.

- What if box 14 on my W-2 does not contain an amount for overtime premium? Does this mean I didn’t have any overtime that qualified in 2025?

- No, it does not necessarily indicate that your overtime for 2025 was not qualified. Qualified overtime is based strictly on FLSA guidelines for overtime, which start after 40 hours of worked time in a week. For you, box 14 not having this may mean that calculations were not clear for 2025 as to what was included in your overtime pay. We recommend you work with your tax professional and keep backup of anything you are claiming for the credit for 2025.

As a general reminder, this page is for informational purposes only and should not be taken as tax advice. If you have questions specific to your 2025 taxes you should consult with your tax professional.

Important Reference Links

- https://www.irs.gov/newsroom/treasury-irs-provide-guidance-for-individuals-who-received-tips-or-overtime-during-tax-year-2025

- https://www.irs.gov/newsroom/one-big-beautiful-bill-provisions

- https://www.irs.gov/newsroom/irsgov-resources-can-help-answer-questions-about-the-one-big-beautiful-bill

Here are some of our credentials and affiliations

Insured and Bonded

Affiliations